PRUSME

The protection every small group needs

Product Features

If the conventional group life cover does not check your boxes, then PRUSME might!

- Policy Term - 12 months (1 year)

- Coverage - Cover is provided to Kenyan citizens or Kenyan residents

- Premium Payment - payable annually in advance.

- Maximum entry age - 24 for full-time students

- Maximum coverage age - 25years

- Premium rates - Dependent on the sums assured.

- Underwriting: Required for sums assured above the free cover limit of Kshs 10 million at an additional premium of Kshs 10,000 per life with a possible review

- Policy Lapse/ Reinstatement - Cover is only provided on premium payment

- Geographical Scope for hospital cash benefit - Republic of Kenya as at the commencement of cover. They may subsequently proceed to and reside in any part of the world without payment of an extra premium. However, no benefits will be paid if the life assured is hospitalised outside the borders of the Republic of Kenya.

Product Benefits

Free Hospital Cash Benefit

Free Grief and Bereavement Counselling

24 Hour, worldwide cover

Active for all covers except Hospital cash

Accidental Death Benefit

Learn more

Waiting period

- Two (2) months

- No waiting period is applied if renewal is made within 1 month from the previous cover period.

Age Limit

Minimum Entry Age Maximum Entry Age Terminal Age / Maximum Coverage Age Main Member 18 years 70 years 71 years Spouse – Last Expense 18 years 70 years 71 years Children – Last Expense 1 month 18 years 19 years Parents & Parents in law – Last Expense

18 years

75 years

76 years

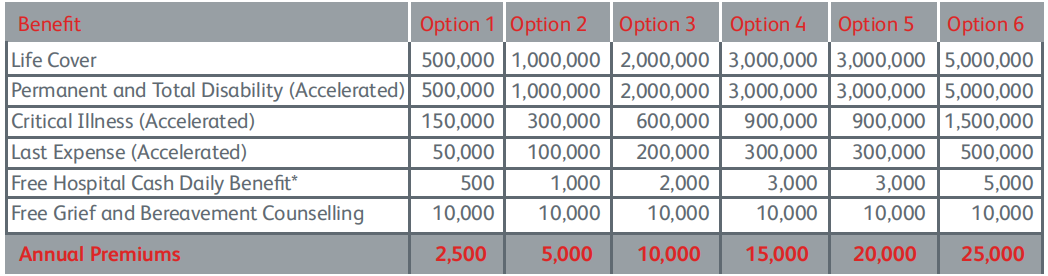

Plan Options

Choose a plan that works for you

Plan AThe sums assured and premiums (applicable) are set out below.

Benefit Option 1 Option 2 Option 3 Option 4 Option 5 Option 6 Life Cover 500,000 1,000,000 2,000,000 3,000,000 3,000,000 5,000,000 Permanent and Total Disability (Accelerated) 500,000 1,000,000 2,000,000 3,000,000 3,000,000 5,000,000 Critical Illness (Accelerated) 150,000 300,000 600,000 900,000 900,000 1,500,000 Last Expense (Accelerated) 50,000 100,000 200,000 300,000 300,000 500,000 Free Hospital Cash Daily Benefit* 500 1,000 2,000 3,000 3,000 5,000 Free Grief and Bereavement Counselling 10,000 10,000 10,000 10,000 10,000 10,000 Annual Premiums 2,500 5,000 10,000 15,000 20,000 25,000 - The hospital cash daily benefit is payable to a maximum of 30 days per year. The benefit is payable after 2 days (from day 3+) of being hospitalized in a NHIF accredited hospital.

- Please note that requests for sums assured above 5 Million under PLAN A will be reviewed and considered on case-by-case basis subject to medical underwriting. Maximum, Kshs 10 million.

- This Plan can be taken by the legal spouse of the principal member. The benefits of the spouse cannot exceed those of the principal member.

Benefit Option 1 Option 2 Option 3 Option 4 Option 5 Option 6 Life Cover 500,000 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 Permanent and Total Disability (Accelerated) 500,000 1,000,000 2,000,000 3,000,000 4,000,000 5,000,000 Critical Illness (Accelerated) 250,000 500,000 1,000,000 1,500,000 2,000,000 2,500,000 Last Expense (Accelerated) 50,000 100,000 200,000 300,000 400,000 500,000 Free Hospital Cash Daily Benefit* 500 1,000 2,000 3,000 4,000 5,000 Free Grief and Bereavement Counselling 10,000 10,000 10,000 10,000 10,000 10,000 Annual Premiums 2,500 5,000 10,000 15,000 20,000 25,000 - The hospital cash daily benefit is payable to a maximum of 30 days per year. The benefit is payable after 2 days (from day 3+) of being hospitalized in a NHIF accredited hospital.

- Please note that requests for sums assured above 5 Million under PLAN B will be reviewed and considered on case-by-case basis subject to medical underwriting. Maximum, Kshs 10 million.

- This Plan can be taken by the legal spouse of the principal member. The benefits of the spouse cannot exceed those of the principal member.

Type of Risk Benefit Description Benefit Level Annual Premium Rate Per Mille GLA All Risks Life Cover Kshs 1 Million to 20 Million 3.40 All Risks Permanent and Total Disability (Accelerated) 100% of Life Cover 0.80 Illness Risks Critical Illness (Accelerated) 30% or 50% of Life Cover subject to a maximum of Kshs 5 Million 3.70 All Risks Last Expense (Accelerated) 10% of Life Cover subject to a maximum of Kshs 500,000 0.00 All Risks Free Hospital Cash Daily Benefit* Kshs 10,000 0.00 All Risks Free Grief and Bereavement Counselling Kshs. 500 daily 0.00 GPA Accidental & Occupational Accidental Death Benefit 200% of the life cover 0.85 Accidental & Occupational Accidental Permanent & Total Disability 200% of the life cover 0.20 Accidental & Occupational Accidental Temporary & Total Disability (TTD) Up to 30% of the life cover subject to a maximum of Kshs 1 million. Payable Monthly for max 1 year. 0.40 Accidental & Occupational Accidental Medical Expense Reimbursement (AMER) Up to 10% of the life cover subject to a maximum of Kshs 500,000 . 10.00 - The hospital cash daily benefit is payable to a maximum of 30 days per year. The benefit is payable after 2 days (from day 3+) of being hospitalized in a NHIF accredited hospital.

Category Option 1 Annual Premiums Option 2 Annual Premiums GLA Spouse 100,000 290 200,000 580 Child 100,000 200 200,000 400 Parent 100,000 1,950 200,000 3,900 Parent-in-law 100,000 1,950 200,000 3,900 Underwriting Requirements

The following information and supporting documents are required:

- Group Profile i.e., registered name, address, business activity and other pertinent details of the proposer.

- Members to be covered and amounts of cover per member including the following details:

- Full name of the members covered.

- Member occupation and residence (town and county).

- Copy of ID (ID number) for the members.

- Full name and copy of ID (ID number) of named beneficiaries for each member covered; and

- Dates of birth for each life covered.

- A duly completed proposal form by the proposer.

- Newly recruited members of the group can join the scheme at any time during the policy cover. An annual premium must be paid at the outset of the cover.

Claim Documentation

Valid Claims will be paid within 72 hours on receipt of full documentation.

Here’s what you’ll need to bring:

Exclusions

Liability will not be accepted for claims occurring because of any of the exclusions below:

- Suicide, attempted suicide, or any self-inflicted injury whether the life assured is sane or insane at the time.

- Any act committed by the policyholder, the life assured or beneficiaries which constitutes a violation of criminal law.

- Abuse of alcohol, wilful inhalation of gas, self-inflicted injury, wilful exposure to radioactivity or the wilful consumption of poison or overdose of drugs (whether the drugs have been prescribed by a medical practitioner or not).

- Any act of war (whether war be declared or not), military action, terrorist activities, riots, strikes, civil

- commotion or insurrection in all cases as an active participant.

- Active participation in mountaineering, horse riding, hunting, motor-racing, power-boat racing or fighting (except in self-defence).

- Participation in any form of aviation other than scheduled air service over an established passenger route.

- Any medical condition not disclosed prior to the issuance of the policy, for which treatment was received or recommended, by a medical practitioner or of which the person assured was aware prior to the date of declaration of the policy.

- Hospitalisation due to elective surgery including cosmetic surgery. Elective surgery is surgery scheduled in advance because it does not involve a medical emergency.

- Hospitalization due to childbirth.

- Any medical condition not disclosed prior to the issuance of the policy, for which treatment was received or recommended, by a medical practitioner or of which the life assured was aware prior to the date of declaration of the policy.

- Any critical illness diagnosis made before the commencement date of the insurance policy or during the waiting period.

- Liability for the claims occurring because of the above exclusions except at the discretion of Prudential management.

Important Notes

- Annual cover renewals should be made within a maximum period of 1 month after cover expiry otherwise the policy will lapse and newly issued policy rules including the 3-month waiting period

- Proof of attendance required for full-time students

Similar products

Not what you’re looking for?

Don’t worry, we'll help you get the correct solution that fits your needs. Provide us with your phone number and we will call you right back.